capital gains tax services

Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate.

Alankit Uae Tax Refund Financial Accounting Firms

Basically if you sell an asset property shares art cryptocurrencies etc for a profit you have two options.

. Reliefs such as Rollover Relief Gift Relief or Business Asset Disposal Relief are available to either reduce or defer the capital gains tax if you meet certain conditions. Capital gains tax is relevant when you sell or gift a property business share incentives and so on. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

A capital gain is the profit you realize when you sell or exchange property such as real estate or shares of stock. The Real Time Capital Gains Tax Service is one of the two ways through which you can pay your Capital Gains Tax CGT bill. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

Capital Gains Tax Monitoring Mitigating tax risks for investment funds The management of tax risks is also important for investment funds as not booking adequate tax provisions can result in financial and reputational risks. If you make a loss from the disposal then you set the loss against gains from another sales. Capital Gains Tax Services.

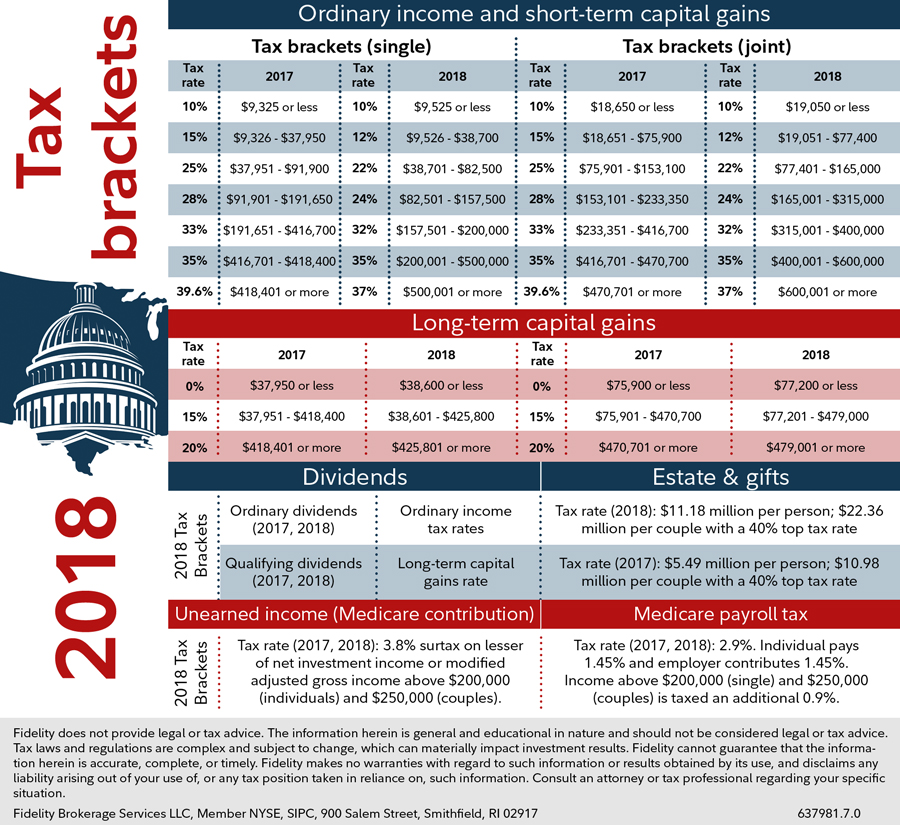

As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. Capital gains provide an excellent opportunity for proactive tax planning due to a variety of minimizationtax elimination strategies available in the tax code. Short-term capital gain tax rates.

Ad Weve helped thousands of people fight against capital gains and capital losses. 2022 long-term capital gains tax brackets. The other piece of bad news is that since you only pay it.

Long-term capital gains tax rate. Further it must be noted that immovable property which is classified as Rural. NJ Income Tax Capital Gains.

EndureGo Tax is the leading CPA accounting firm in Ashfield Inner West Sydney Northern Beaches and Adelaide. If you are a New Jersey resident all of your capital gains except gains from the sale of exempt obligations are subject to tax. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent.

Washington Attorney General Bob Ferguson announced that he intends to appeal this decision. Short-term capital gains are gains apply to assets or property you held for one year or less. Long-term capital gains apply to assets that you held for over one year and are taxed differently.

For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. You are well served to work through your trusted tax advisor andor a service like the HR Block tax calculator to help you work through this maze of rules on calculating your capital gain. Plot of land residential flats or house commercial properties etc.

Capital gains tax rates on most assets held for a year or less correspond to. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25 rate. ICE Data Servicess Capital Gains Tax CGT services can help to improve the efficiency of the day-to-day work carried out by accountants tax professionals investment managers and bankers amongst others.

This work includes CGT calculations completion of CGT and income tax returns and tax planning as well as portfolio management. Here are the 2022 and 2021 capital gains rates. If you sell a capital asset at a loss which typically means your selling price is.

Deloitte provides a global capital gains tax monitoring service for investment funds to ensure that potential capital gains. For tax purposes your capital loss is treated differently than your capital gains. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

So if you are thinking of selling your house downsizing your home selling cryptocurrency and worrying about the capital gain and how much you need to pay the tax worry no more. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. First calculating capital gains tax can be very complicated.

Capital Gains Tax CGT Capital Gains Tax is a tax on the profit you make from disposing of your asset. Capital gains are a common situation for our client base. NJ Income Tax Capital Gains.

Capital gains tax advice is there to help you pay this tax in the best way possible. 2021 long-term capital gains tax brackets. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

Mark Hawkins Director State Local Tax Services. If you sell them for more than you bought them for capital gains tax is a tax on the profit you make. Calculating Capital Gains Tax.

The capital gains tax on most net gains is no more than 15 percent for most people. 10000 of that again would be taxed at 19 per cent which would take them to the next tax. Our professional CPA accountants can look after all aspects of capital gain taxes.

In cases where you must simply pay tax it also makes sense to hire a CPAaccounting professional to help you compute and plan for the tax bill. Lets say a couples total taxable income from working a job and capital gains is 83000. Then there is the bad news and its two fold.

Are treated as Capital Assets us 2 14 of the Income-tax Act 1961 the Act and accordingly gains arising from the transfer of immovable property is chargeable to income tax. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. On March 1 2022 Douglas County Superior Court Judge Brian Huber concluded the Washington State capital gains tax CGT to be unconstitutional under the Washington Constitution.

Suppose a person earned 35000 a year and made a taxable capital gain of 30000 after the discount. At Greenlight Were Committed to Providing the Best Financial Services for Our Clients. If youre looking for capital gains tax advice it means there could potentially be a big life-changing.

The couple could pay 0 on profits for stocks held over a year if they are married filing jointly. You either file a Self Assessment tax return by January 31st of the following tax year.

Details Of Capital Gain On Your Plot Sale Taxation Aspect Capital Gain Filing Taxes Tax Services

Cryptocurrency And Taxes Virtual Currency Income Tax Preparation Capital Gains Tax

Tax On Capital Gains For Non Resident Of India Nri Capital Gain Legal Services Capital Gains Tax

Tax Consultant In Kolkata Capital Gains Tax Income Tax Goods And Service Tax

Best Tax Consulting Sico Tax Tax Consulting Capital Gains Tax Tax Refund

Pin By Investopedia Blog On Finance Terms Capital Gain What Is Capital Capital Gains Tax

Taxation Service In Melbourne In 2022 Capital Gains Tax Startup Advice Accounting Services

Tax Services Income Tax Return Income Tax Capital Gain

20 Types Of Taxes In India Types Of Taxes Tax Memes Money Management Advice

How Clear Tax Accountants Are Reasonable For Their Services Tax Accountant Business Tax Debt Management

Pin By Pdf Base On Form W 8 Ben E Capital Gains Tax Business Tax Tax Services

Incometaxaccountant Bellflower Ca Capital Gains Tax Income Tax Tax Services

Section 721 Exchange Capital Gains Tax Real Estate Investment Trust Capital Gain

How To Pay Income Taxes Capital Gains Tax Storefront Signs Tax Payment

Income Tax Return Services Income Tax Return Income Tax Tax Return

Tax Preparer Near Me Tax Preparation Tax Services Tax

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

Tax Consulting Services Flyer Poster Template Tax Consulting Income Tax Return Tax Return

Tax Preparation Service Now Income Tax Service Tax Preparation Tax Services Tax Preparation Services